One of the defining characteristics of Sherlock Holmes (besides the deerstalker hat and overcoat) is his almost superhuman powers of deduction. In the first Sherlock novel, A Study in Scarlet, Holmes says, “From a drop of water, a logician could infer the possibility of an Atlantic or a Niagara without having seen or heard of one or the other.” In every Sherlock story since, Sherlock does indeed turn tiny, seemingly insignificant details into solved crimes. Now, if you’re tasked with evaluating a Bank Secrecy Act Anti-Money Laundering (BSA/AML) system, you might feel like you’re being asked to perform Sherlockian levels of deduction. Or worse yet, you may be fooling yourself into thinking you have the fictional skills it would take to evaluate and optimize your AML system by looking solely at the number of alerts your AML system generates.

One of the defining characteristics of Sherlock Holmes (besides the deerstalker hat and overcoat) is his almost superhuman powers of deduction. In the first Sherlock novel, A Study in Scarlet, Holmes says, “From a drop of water, a logician could infer the possibility of an Atlantic or a Niagara without having seen or heard of one or the other.” In every Sherlock story since, Sherlock does indeed turn tiny, seemingly insignificant details into solved crimes. Now, if you’re tasked with evaluating a Bank Secrecy Act Anti-Money Laundering (BSA/AML) system, you might feel like you’re being asked to perform Sherlockian levels of deduction. Or worse yet, you may be fooling yourself into thinking you have the fictional skills it would take to evaluate and optimize your AML system by looking solely at the number of alerts your AML system generates.

Although the number of alerts is meaningful information, it does not tell the full story. And, unless you’re Sherlock Holmes, this information alone won’t answer the questions: Did the alert result in an investigation? Did the investigation result in a SAR filing? The answers to these and other questions can reveal the places where adjustments to the AML system’s effectiveness and efficiency are advisable. Looking at your alerts on a spectrum where one end is the origination of an alert and on the other end is a SAR filing, most of your alerts likely fall somewhere in the middle. This means a lot of investigation resources invested in non-SARs or, what is worse, legitimately suspicious activities slipping through the cracks. And if your institution can’t get things under control, it could be subject to dreaded look-back projects and other costly penalties.

Whatever AML system you’re using, whether it’s the most expensive platform with all the bells and whistles or an Excel spreadsheet built by Tom in operations, its effectiveness and efficiency are capped by how much effort has gone into refining it to fit your institution’s circumstances and your constantly evolving base of members. Because there is no industry-wide set of rule parameters for identifying transactions that should result in an alert to be investigated, it takes an investigation of each individual institution’s current system to make any improvement.

Waterfall Parameters

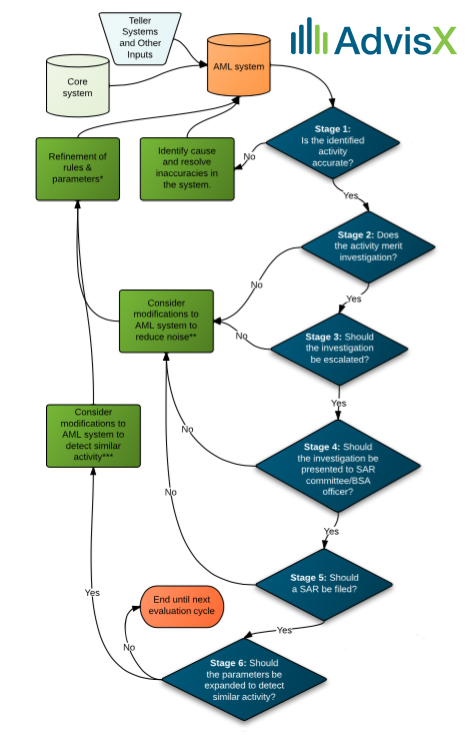

As I’ve traveled to dozens of financial institutions across the country struggling with balancing their Anti-Money Laundering Systems between too many and too few alerts, I’ve identified what I call the “waterfall” diagram, which has proven to be an effective model in the process of optimizing an AML system. Named for its sequential flow through six stages, this model provides a framework for stepping back and tracking alerts from a given period of time through six stages:

1) Is the identified activity accurate?

1) Is the identified activity accurate?

2) Does the activity merit investigation?

3) Should the investigation be escalated?

4) Should the investigation be presented to SAR committee?

5) Should a SAR be filed?

6) Should parameters be expanded to detect similar activity?

If the answer to each question is “yes,” your rule parameters for a given alert functioned as designed, enabling you to file a suspicious activity report and consider whether the rule parameters should be expanded to detect similar activities. But each “no” along the way presents an opportunity for the institution to fall back and consider modifications to the current AML rule parameters to reduce “noise” (alerts that have limited or no meaningful value in identifying suspicious and/or fraudulent activities, thereby absorbing finite credit union resources). With strong case management that tracks the stages hit by each alert, a credit union can revise its parameters with statistical support on activity that promotes regulatory acceptance of parameter adjustments.

Furthermore, it is that same insight provided by a strong case management system that will allow credit unions to truly see what impact parameter modifications have. Successful programs make adjustments to test what works, but the key to lasting improvement is knowing how the AML system was affected by the change. Otherwise, it’s just a guessing game.

If you don’t currently employ Sherlock Holmes as the overseer of your institution’s AML program, don’t limit your homework to an analysis of simple alerts. Use the AML waterfall model to help refine your analysis to fit your institution’s circumstances and your ever-transforming base of members. Once you’ve completed this type of analysis, your institution will be able to make informed parameter modifications as needed, resulting in a top-notch AML program.

For a limited time, we’re offering a complimentary copy of AdvisX’s AML Rule Parameters Waterfall Model. Contact Melanie Gulakowski to receive your free copy.