INTRODUCING THE ADVISX TEAM

AdvisX’s highly skilled team specializes in providing advisory compliance services to help financial companies know what is needed to improve compliance with regulations at their institution. The firm has a long history of combining real-world compliance experience with pragmatic technological innovations to help financial companies effectively manage the cost of regulatory risk through innovative technologies and skilled personnel.

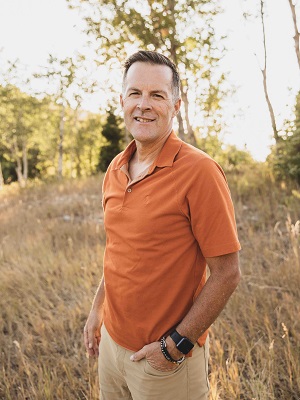

KEN AGLE

SUBJECT MATTER EXPERT

A former FDIC examiner and industry consultant, Ken brings over 34 years of experience covering numerous facets of financial institution operations. Mr. Agle specializes in strategic regulatory response and in developing and implementing both proactive and reactive tools and systems to preempt and resolve issues affecting today’s financial institutions. He has worked directly and indirectly with hundreds of financial institutions throughout the United States dating back to his co-founding of his California firm, The Triac Company, in 1992.

HANNALEE ALLEN

DATA ANALYST

With several years of banking experience and material expertise in statistical analysis in writing and programming, Hannalee specializes in BSA and AML validations, as well as Fair Lending and CRA validations, and has conducted analyses on several financial institutions. She also participates as a contributing editor for the online publication Risk InboX, a website dedicated to curating pertinent and timely financial news. Hannalee is a graduate of Brigham Young University, where she majored in Applied Statistical Science.

ISAAC KELLEY

DATA ANALYST

Isaac Kelley is a Data Analyst for AdvisX. He has a background in statistics and programming with experience in banking. He is proficient in several coding languages including C++, Java, R, SQL, and Python. He contributes to the process of performing validations by actively seeking opportunities to increase efficiency, accuracy, and productivity in the validation process. Isaac is a soon to be graduate of Brigham Young University, where he is majoring in Statistical Science with an emphasis in Data Science and a Computer Science minor.

TD WILCOX

DATA ANALYST

TD Wilcox is a Data Analyst for AdvisX. He has experience in statistical analysis writing and programming in several languages, including R. He specializes in BSA/AML validations as well as creating a Fair Lending scoring system based on predictions. Additionally, he participates as a contributing editor in monitoring regulatory change and current events for the online publication Risk InboX, a website dedicated to curating pertinent and timely financial news. TD is a graduate of Brigham Young University, where he majored in Statistical Science.

ERIC HELFRICH

IN-HOUSE COUNSEL & CHIEF TECHNOLOGY OFFICER

Eric is seasoned IT professional with over 17 years of experience developing innovative solutions for companies from healthcare to banking. He is a Certified Oracle and SQL Server database administrator and is the chief architect of the AdvisX Risk Management Platform. As Database Administrator for BillMeLater (Paypal) he managed databases, which supported real time credit-decisioning process. He built and tuned a data warehouse based on USPS Criss Cross, which implemented fuzzy logic sub-second searches to validate input addresses and rate address quality. He has worked on numerous ETL projects involving flat file data from a variety of source platforms.

ANGELI BUTLER

CLIENT LIAISON

As client liaison and marketing specialist, Angeli provides support to the skilled AdvisX team and acts as an interface and point of contact for clients. With a varied background including blogging, web design, product development, and marketing/customer service coordination, she aims to facilitate clear communication and foster the flexibility that enables the AdvisX team to meet the varied needs of individual banks, agencies, and credit unions. A National Merit Scholarship Finalist, Angeli graduated from Brigham Young University with a B.S. in Psychology.

Risk and compliance services trusted by financial companies throughout the world.

LEADING MINDS. LATEST PUBLICATIONS.

The Human Touch – A New Concept in Validation

Long before ChatGPT, movies (and other media) warned us of the dangers of creations outstripping their creators. One basic [...]

Water and the Spectrum of AML Risk

Spectrums Within the Spectrum Water is an amazing thing. In fact, it is a very unusual substance. Think about [...]

The Ripple Effect

Learning From The Ripple Effect—Virtual Assets and Virtual Asset Service Providers I have always been fascinated by the ripple [...]

AML Meets D&D: Subduing the Monster

80s Nostalgia and BSA/AML Image by Aakansha Trivedi via Wikipedia Watching Stranger Things (Netflix series in its [...]